Content

Get mode FTB 3809, Focused Taxation Town Deduction and you may Borrowing Realization, to find out more. Taxpayers cannot generate/sustain people Corporation Region (EZ) Book Of Diamonds casino game otherwise Local Company Military Ft Recuperation Area (LAMBRA) NOL to have nonexempt decades birth to the otherwise immediately after January step one, 2014. Taxpayers can be claim EZ otherwise LAMBRA NOL carryover deduction of previous many years. Rating form FTB 3805Z, Corporation Region Deduction and you may Borrowing from the bank Realization, otherwise FTB 3807, Regional Service Military Ft Data recovery Urban area Deduction and Borrowing from the bank Summary, to learn more. To possess taxable years birth to the otherwise once January step 1, 2019, NOL carrybacks are not invited. The fresh NOL carryover deduction is the level of the fresh NOL carryover from previous many years which may be subtracted out of earnings on the newest taxable seasons.

Book Of Diamonds casino game: No-put Roulette Incentives to own Uk Anyone : 15+ Roulette Offers

Report your own gains and you can losses from the sales otherwise exchanges out of funding property that aren’t effectively associated with a swap or organization in the us to your Plan NEC (Mode 1040-NR). Report growth and you will losings of sales otherwise exchanges out of financing assets (as well as real property) that are effortlessly associated with a swap otherwise organization from the All of us to the another Agenda D (Setting 1040) or Function 4797, otherwise both. When you are engaged in a great You.S. trade or business, all income, obtain, otherwise loss to your taxation season that you will get out of supply inside the Us (other than certain funding earnings) try managed since the effectively connected income.

Unique Laws to possess Canadian and you can German Public Security Professionals

You need to mount a completely finished Setting 8840 for the money tax go back to allege you may have a deeper connection to a great foreign country otherwise nations. Although we can be’t work myself every single opinion gotten, i perform appreciate your own feedback and certainly will consider carefully your comments and suggestions even as we modify our very own income tax models, tips, and guides. Don’t post tax concerns, tax returns, otherwise repayments for the more than target.

- You generally get this to alternatives after you file the joint go back.

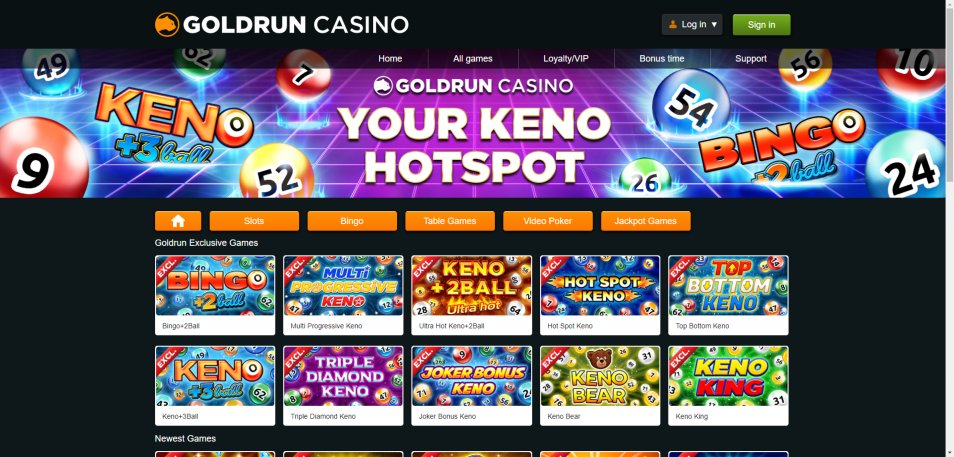

- During my analysis, I put a total of four additional criteria to choose if a gambling establishment has a right to be in this article, after which I ranked the new casinos against each other.

- Go into the total of the many nonexempt desire along with people new issue disregard ties and you will money obtained because the an owner from a normal demand for a good REMIC.

Individual services earnings you will get within the a tax seasons where you are involved with an excellent U.S. change otherwise business is effectively related to a You.S. trade or company. Money acquired within the a year apart from the entire year you did the support is also efficiently linked if this could have been effectively connected in the event the acquired in you performed the assistance. Personal services money boasts earnings, wages, earnings, fees, for each diem allowances, and you will personnel allowances and you will bonuses. The amount of money could be paid back for you in the way of dollars, characteristics, otherwise possessions. Resident aliens are generally taxed in the same manner because the U.S. residents. Nonresident aliens is taxed in accordance with the supply of its money and you can even when the earnings is actually effortlessly linked to a good U.S. trade or company.

Just making it through this type of totally free transforms takes your a great little bit of day because there are simply a lot of of these. Yet not, Royal Las vegas Casino won’t disappoint using their complete online game choices after you happen to be concluding and able to is actually something else. That it small deposit on-line casino could have been preferred for some time go out mostly by the large numbers from titles they have in the greatest team in the game. Top10Casinos.com does not give playing institution which is not a playing driver. You can expect gambling enterprise and wagering also offers from third-party gambling enterprises. Top10Casinos.com are supported by our clients, when you simply click all ads to your our webpages, we would earn a percentage in the no additional prices to you.

An educated $5 Lowest Put Bonuses within the NZ

Save money and steer clear of unwelcome unexpected situations by avoiding these twenty five very first-go out renter errors. If you’d like to find out more about your own occupant’s liberties listed below are some such additional tips so you can generate the best of the renting sense. Should your property manager must pay you accrued attention, it must be produced in your own rent. If you don’t see this short article on the book, here are some the simple reference county-by-county summary. Your landlord can charge your various fees for example later, amenity (gymnasium, laundry), early termination, online credit card processing, software, attorneys, vehicle parking, and you will storage charge. As we don’t offer people chapels for the university, you will find chaplains at each people you to hold non-denominational spiritual services to possess owners.

The cause away from a taxation compensation perimeter work with is determined based to your precise location of the legislation one to enforced the new tax to have you is actually refunded. You need to use a great equipment of your time less than twenty four hours on the above tiny fraction, if suitable. The time period where the brand new settlement is created doesn’t must be annually. As an alternative, you need to use various other distinct, independent, and continued period of time if you possibly could expose to the satisfaction of the Irs that this other several months is much more appropriate. If you were a great U.S. citizen within the 2024 but they are not a good You.S. resident throughout the people element of 2025, you quit becoming a great You.S. citizen on your abode termination day. The house cancellation go out is December 29, 2024, if you don’t qualify for an early on go out, since the discussed later.